SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ||

¨ Confidential, for Use of the Commission Only (as

| ||

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to Section 240.14a-12 |

CASEY’S GENERAL STORES, INC.

(Name of Registrant as Specified In Its Charter)

[NOT APPLICABLE]Not Applicable]

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

[Not Applicable]

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

[Not Applicable]

August 11, 20085, 2011

To Our Shareholders:

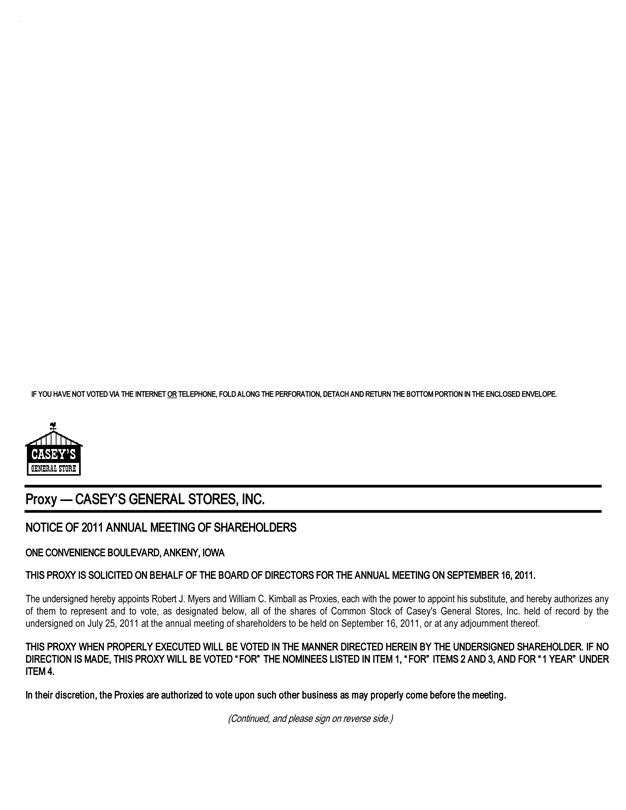

The Annual MeetingI am pleased to invite you to attend the annual meeting of the shareholders of Casey’s General Stores, Inc. will(“Casey’s”) to be held at the9:00 a.m., Central Time, on September 16, 2011, at Casey’s General Stores, Inc. Corporate Headquarters, One Convenience Blvd., Ankeny, Iowa at 9:00 A.M., central time, on Friday, September 19, 2008. (the “Annual Meeting”).

The formalaccompanying Notice of Annual Meeting of Shareholders and Proxy Statement which are contained indescribe the following pages, outline the two proposalsmatters to be considered and voted upon by shareholders at the Annual Meeting. At the Annual Meeting, we also will report on our results this past year and our first quarter results for the fiscal year ending April 30, 2012, and you will have an opportunity to ask questions.

We hope all of our shareholders will be able to attend the Annual Meeting. It is important that your sharesyou be represented, at the meeting whether or not you are personally ableplan to attend. To make it easier forattend the Annual Meeting personally. Please promptly complete, sign, date and return the enclosed proxy card in the postage-paid envelope provided to ensure that your vote will be received and counted. Alternatively, you tomay vote your shares, you now have the choice of voting over the Internet,proxy card by telephone or by completing and returningthrough the enclosed proxy card. The proxy card describes your voting optionsInternet as described in greater detail. If you later find that you may be present formore detail in the meeting or for any other reason desire to revoke your proxy, you may do so at any time before it is voted.

Your copysection of the Company’saccompanying Proxy Statement entitled “About the Annual ReportMeeting—How to Vote; Submitting Your Proxy; Revoking Your Proxy.”

On behalf of the Board of Directors and Form 10-KCasey’s management, thank you for 2008 is also enclosed. Please read it carefully. It gives you a report on the Company’s operations for the fiscal year ended April 30, 2008.

Weyour support, and we look forward to seeing you at the meeting and thank you for your continued interest in the Company.meeting.

| Sincerely, |

|

| Robert J. Myers |

| President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

SEPTEMBER 19, 200816, 2011

To the Shareholders of Casey’s General Stores, Inc.:

The Annual Meetingannual meeting of the shareholders of Casey’s General Stores, Inc., an Iowa corporation (“Casey’s”), will be held at the Casey’s General Stores, Inc. Corporate Headquarters, One Convenience Boulevard,Blvd., Ankeny, Iowa, on Friday, September 19, 2008,16, 2011, at 9:00 A.M., central time,Central Time (the “Annual Meeting”), for the following purposes:

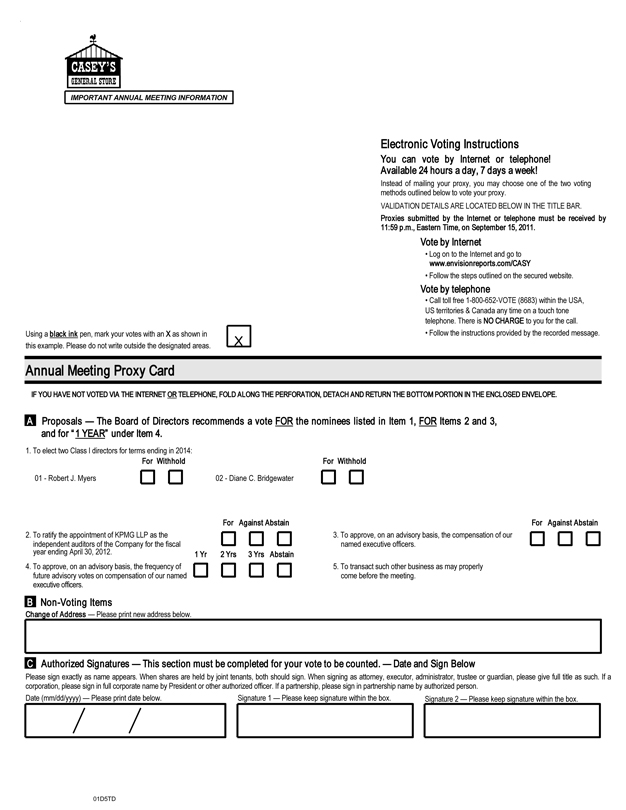

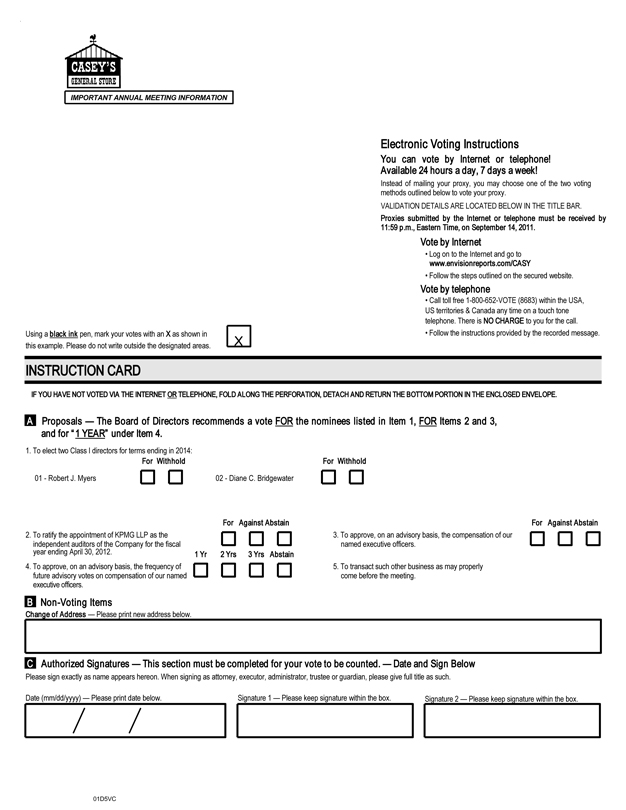

| 1. | To elect |

| 2. | To ratify the appointment of KPMG LLP as |

| 3. | To hold an advisory vote on our named executive officer compensation; |

| 4. | To hold an advisory vote on the frequency of future advisory votes on our named executive officer compensation; and |

| To transact such other business as may properly come before the |

The Boardabove matters are described in the Proxy Statement accompanying this Notice. You are urged to read the Proxy Statement carefully, and to vote by using one of Directors has fixedthe following methods, whether or not you plan to attend the Annual Meeting: (a) vote by telephone, (b) vote via the Internet or (c) complete, sign, date and return your proxy card in the postage-paid envelope provided. Voting instructions are described in more detail in the section of the accompanying Proxy Statement entitled “About the Annual Meeting—How to Vote; Submitting Your Proxy; Revoking Your Proxy.”

Only shareholders of record of Casey’s Common Stock at the close of business on July 25, 2008, as the record date for the determination of shareholders2011 are entitled to notice of, and to vote at, this meeting and at any and all adjournments thereof. A list of such holders will be open for examination by any shareholder, at the Company’s Corporate Headquarters at the address described above, beginning two business days after the date hereof and continuing through the meeting.Annual Meeting.

| By Order of the Board of Directors, |

|

| Brian J. Johnson |

| Secretary |

August 11, 20085, 2011

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on September 19, 2008.16, 2011

The Proxy Statement and Annual Report to shareholders are available

at www.edocumentview.com/casy.www.envisionreports.com/casy

PROXY STATEMENTTABLE OF CONTENTS

General

The annual meeting of shareholders of Casey’s General Stores, Inc. (“Casey’s”, the “Company”, “we”, “our” or “us”) will be held at 9:00 a.m., Central Time, on September 16, 2011, at Casey’s Corporate Headquarters, One Convenience Blvd., Ankeny, Iowa (the “Annual Meeting”). The mailing address of the Company’s principal executive offices is P.O. Box 3001, One Convenience Blvd., Ankeny, Iowa 50021-8045. This Proxy Statement and the accompanying proxy card are first being given or voting instruction card are being mailed beginning on or about August 11, 2008,5, 2011 to each holder of record of the Common Stock,common stock, no par value (the “Commonper share (“Common Stock”), of Casey’s General Stores, Inc. (the “Company”) at the close of business on July 25, 2008. Proxies in2011 (the “Record Date”). On the form enclosed are solicited by theRecord Date, there were 38,044,209 shares of Common Stock outstanding. Each share of Common Stock will be entitled to one vote on all matters.

Casey’s Board of Directors (the “Board of Directors” or “Board”), through this Proxy Statement and the Companyaccompanying proxy card, is soliciting your vote on matters being submitted for useshareholder approval at the Annual Meeting and any adjournments or postponements thereof. At the Annual Meeting, shareholders will vote on the election of two directors, the ratification of KPMG LLP as Casey’s independent auditor for 2012, an advisory vote on our named executive officer compensation, an advisory vote on the frequency of such future “say on pay” votes , and such other business as may properly come before the Annual Meeting.

The Board of Directors is not aware at this date of any matter proposed to be presented at the Annual Meeting other than those described in this Proxy Statement. The persons named on the accompanying proxy card will have discretionary authority to vote on any other matter that is properly presented at the meeting, according to their best judgment.

Securities Entitled to Vote

The only securities eligible to be voted at the Annual Meeting are shares of Common Stock. Only holders of Common Stock at the close of business on the Record Date (July 25, 2011) are entitled to vote. Each share of Common Stock represents one vote, and all shares vote together as a single class. There were 38,044,209 shares of Common Stock issued and outstanding on the Record Date.

Quorum; Vote Required

The presence in person or by proxy of shareholders entitled to cast a majority of all the votes entitled to be heldcast at the Casey’s General Stores, Inc. Corporate Headquarters, One Convenience Boulevard, Ankeny, Iowa 50021,meeting constitutes a quorum. Shareholders are entitled to one vote per share. Shares of Common Stock held by shareholders abstaining from voting but otherwise present at 9:00 A.M., central time,the meeting in person or by proxy (“abstentions”) and votes withheld are included in determining whether a quorum is present. Broker shares that are not voted on Friday, September 19, 2008.a particular proposal because the broker does not have discretionary voting power for that proposal and has not received voting instructions from the beneficial owner (“broker non-votes”) are included in determining whether a quorum is present.

ShareholdersIn the election for directors, every shareholder has the right to vote each share of recordCommon Stock owned by such shareholder on the Record Date for as many persons as there are directors to be elected. Cumulative voting is not permitted. To be elected, a director-nominee must receive a plurality of the votes cast at the meeting. Only votes cast FOR a nominee will be counted. Abstentions, votes withheld and broker non-votes will not be counted as votes cast for such purpose and therefore will have no effect on the results of the election.

The proposal to ratify the selection of the independent auditors must receive a majority of the votes cast at the Annual Meeting. Abstentions will not be counted as votes cast for such purposes and therefore will have no effect on the results of the vote.

To be approved, the advisory non-binding resolution on our named executive officer compensation must receive a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will not be counted as votes cast for such purposes and therefore will have no effect on the results of the vote.

For the vote concerning the frequency of future advisory votes on our named executive officer compensation, the alternative receiving a plurality of the votes cast at the Annual Meeting will be deemed to be the preferred alternative of the shareholders. Abstentions will not be counted as votes cast for such purpose, and therefore will have no effect on the results of the vote.

How To Vote; Submitting Your Proxy; Revoking Your Proxy

Your vote is very important to the Company. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares today.

You may vote your shares either by voting in person at the Annual Meeting or by grantingsubmitting a completed proxy. Holders of Common Stock being held in street name mayBy submitting a proxy, you are legally authorizing another person to vote by submitting voting instructions to their broker or nominee. In either circumstance, shares may be voted in one of the following ways:

By Internet at the address listed on the proxy card;

By telephone using the toll-free number listed on the proxy card;

By returning theyour shares. The enclosed proxy card (signeddesignates Robert J. Myers and dated) in the envelope provided.

When a shareholder votes by proxy, theWilliam C. Kimball to vote your shares represented thereby will be voted at the meeting in accordance with the shareholder’s instructions. voting instructions you indicate on your proxy card.

If no instructions are given on a signedyou submit your executed proxy card designating Messrs. Myers and Kimball as the proxy willindividuals authorized to vote your shares, but you do not indicate how your shares are to be voted,FOR the election as directors of the nominees named herein andFOR ratification of the appointment of KPMG LLP as the Company’s independent auditor for the fiscal year ending April 30, 2009.

A person giving a proxy may revoke it at any time before it is voted. Any shareholder attending the meeting may, on request, vote his or her own then your shares even though the shareholder has previously granted a proxy. Unless revoked, the shares of Common Stock represented by proxies will be voted by those individuals in accordance with the Board of Directors’ recommendations, which are described in this Proxy Statement. In addition, if any other matters are properly brought up at the Annual Meeting (other than the proposals contained in this Proxy Statement), then each of these individuals will have the authority to vote your shares on allthose matters in accordance with his discretion and judgment. The Board of Directors currently does not know of any matters to be acted uponraised at the meeting.Annual Meeting other than the proposals contained in this Proxy Statement.

For participants inWe urge you to vote by doing one of the Casey’s General Storesfollowing:

| • | Vote by Mail: You can vote your shares by mail by completing, signing, dating and returning your proxy card in the postage-paid envelope provided. In order for your proxy to be validly submitted and for your shares to be voted in accordance with your instructions, please mail your proxy card in sufficient time for it to be received by the morning of September 16, 2011. |

| • | Vote by Telephone: You can also vote your shares by calling the number (toll-free) indicated on your proxy card at any time on a touch-tone telephone and following the recorded instructions. If you submit your proxy by telephone, then you may submit your voting instructions up until 11:59 p.m., Eastern Time, on September 15, 2011. If you are a beneficial owner, or you hold your shares in “street name” as described below, please contact your bank, broker or other holder of record to determine whether you will be able to vote by telephone. |

| • | Vote by Internet: You can vote your shares via the Internet by going to the Web site address for Internet voting indicated on your proxy card and following the steps outlined on the secure Web site. If you submit your proxy via the Internet, then you may submit your voting instructions up until 11:59 p.m., Eastern Time, on September 15, 2011. If you are a beneficial owner, or you hold your shares in “street name” as described below, please contact your bank, broker or other holder of record to determine whether you will be able to vote via the Internet. |

If you hold shares through the Company’s 401(k) Plan (the “KSOP”), such shares are not registered in your name, and your name will not appear in the voting instruction card directs Delaware Charter Guarantee &Company’s register of shareholders. Instead, your shares are registered in the name of a trust, which is administered by Principal Trust Company (the “Trustee”),. Only the trustee ofTrustee will be able to vote your shares (even if you personally attend the KSOP, with respect to voting of the shares held in the participants’ accounts. Participantsmeeting). You can direct the voting of

the shares allocated to theiryour accounts on the Internet, by telephone or by returning the signed instructionproxy card in the envelope provided, but cannot direct the voting of theiryour KSOP shares in person at the meeting. If voting instructions for shares in the KSOP are not returned, those shares will be voted by the Trustee in the same proportion as the shares for which voting instructions are returned by the other participants in the KSOP.To allow sufficient time for the Trustee to tabulate the vote of the KSOP shares, participant instructions must be received before the close of business11:59 p.m., Eastern Time, on September 17, 2008.14, 2011.

The costIf you have previously submitted a proxy card, you may change any vote you may have cast by following the instructions on the proxy card to vote by telephone or via the Internet, or by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided, or by attending the Annual Meeting and voting your shares in person. If your shares are registered in the “street name” of soliciting proxiesa bank, broker or other holder of record, please contact the applicable bank, broker or record holder for instructions on how to change or revoke your vote.

Your proxy is revocable. If you are a shareholder of record, after you have submitted your proxy card, you may revoke it by mail before the Annual Meeting by sending a written notice to Brian J. Johnson, Vice President—Finance and Corporate Secretary, Casey’s General Stores, Inc., P.O. Box 3001, One Convenience Blvd., Ankeny, Iowa 50021-8045. If you wish to revoke your submitted proxy card and submit new voting instructions by mail, then you must sign, date and mail a new proxy card with your new voting instructions. Please mail any new proxy card in sufficient time for it to be received by the morning of September 16, 2011. If you are a shareholder of record and you voted your proxy card by telephone or via the Internet, you may revoke your submitted proxy and/or submit new voting instructions by that same method, which must be received by 11:59 p.m., Eastern Time, on September 15, 2011. You also may revoke your proxy card by attending the Annual Meeting and voting your shares in person. Attending the Annual Meeting without taking one of the actions above will not revoke your proxy. If you are a beneficial owner, or you hold your shares in “street name” as described below, please contact your bank, broker or other holder of record for instructions on how to change or revoke your vote.

Your vote is very important to the Company. If you do not plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your completed proxy card prior to the Annual Meeting in accordance with the above instructions so that your shares will be borne byrepresented and voted in accordance with your instructions. Even if you plan to attend the Company. The Company expectsAnnual Meeting in person, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to solicit proxies primarily by mail. Proxies may also be solicited personally and by telephone by certain officers and regular employeesattend the Annual Meeting.

If your shares are not registered in your name but in the “street name” of the Company. The Company may reimburse brokers and their nominees for their expenses in communicating with the persons for whom they hold shares of the Company.

1

SHARES OUTSTANDING

Holdersa bank, broker or other holder of record (a “Nominee”), then your name will not appear in the Company’s register of the Common Stock at the close of business onshareholders. Your Nominee, as the record date, July 25, 2008,holder of your shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to your Nominee, your Nominee will be entitled to vote the shares with respect to “discretionary” items but will not be permitted to vote the shares with respect to “non-discretionary” items (those shares are treated as broker non-votes). The election of directors will be a “non-discretionary” item for any Nominee holding shares on your behalf. In addition, the two advisory votes on our named executive officer compensation and the frequency of such advisory votes in the future will be “non-discretionary” items. As a result, if your shares are held in “street name” and you do not provide instructions as to how your shares are to be voted, your Nominee will not be able to vote your shares in the election of directors or on the two advisory proposals. Note that even if you attend the Annual Meeting, you cannot vote the shares that are held by your Nominee unless you have a proxy from your Nominee. If you do not provide instructions to your Nominee and your Nominee does not vote your shares on your behalf with respect to the ratification of the selection of the independent auditors (which is a “discretionary” item), your shares will not be counted in determining whether a quorum is present for the Annual Meeting. If your Nominee exercises its “discretionary” authority to vote your shares on the ratification of the selection of the independent auditors, your shares will be counted in determining whether a quorum is present for all matters to be presented at the Annual Meeting. OnWe urge you to provide instructions

to your Nominee so that your votes may be counted on these important matters. Please contact your Nominee for the record date, 50,772,162 sharesdeadlines for submission of Common Stock were outstanding. Each such shareyour vote. Your proxy is revocable. Please contact your Nominee for instructions on how to change or revoke your vote.

Important Notice Regarding the Availability of Common Stock will be entitledProxy Materials for the Annual Meeting

Information on how to one vote on all matters.

The following table contains information with respect to each person, including any group, known to the Company to be the beneficial owner of more than 5% of the Common Stock of the Company as of the dates indicated in the footnotes following the table. Except as otherwise indicated, the persons listed in the table have the voting and investment powers with respect to the shares indicated.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||

Barclays Global Investors, NA 45 Fremont Street San Francisco, CA 94105 | 3,595,929 | (1) | 7.10 | % |

2

VOTING PROCEDURES

Under Iowa corporate law and the Amended and Restated Bylaws, as amended, of the Company (the “Bylaws”), the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the 2008 Annual Meeting.

Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. Accordingly, the eight nomineesobtain directions for election as directorsattendance at the Annual Meeting who receiveand to vote in person are available by contacting Brian J. Johnson, Vice President—Finance and Corporate Secretary, at (515) 965-6587, or by writing to us at:

Casey’s General Stores, Inc.

Corporate Secretary

P.O. Box 3001

One Convenience Blvd.

Ankeny, Iowa 50021-8045

The Company makes available, free of charge on its Web site, this Proxy Statement, the greatest number of votes cast for election will be the duly elected directors. The affirmative vote of a majorityAnnual Report to Shareholders, Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the sharesSecurities Exchange Act of Common Stock present in person1934, as amended (the “Exchange Act”) as soon as reasonably practicable after these documents are electronically filed with, or represented by proxy is required for ratification offurnished to, the appointment ofSEC. These documents are posted on the independent auditor. AbstentionsWeb site at www.caseys.com. Select the “Investors” link and any “broker non-votes,” which occur when brokers are prohibited from exercising voting authority for beneficial owners who have not provided voting instructions, will not be counted for the purpose of determining the number of votes cast.choose “SEC Filings”.

ELECTION OF DIRECTORS

TheIntroduction

With the passing of Ronald M. Lamb on June 11, 2010, the Board of Directors currently consists of eight persons. Under the Restatement of the Restated and Amended Articles of Incorporation, as amended (the “Restated Articles”), the Board of Directors may consist of up to nine persons, and individuals may be elected by the Board to fill any vacancies or to occupy any new directorships,directorships. The person filling such vacancy or newly-created directorship would serve out the remainder of the term of the vacated directorship or, in the case of a new directorship, the term designated for the particular director.

In accordance with such individual servingrecent amendments to the Iowa Business Corporation Act (the “Act”), the Restated Articles were amended by the Board of Directors on May 19, 2011 to implement the staggering of the terms of directors required by new Section 490.806A, subsection 1, of the Act. Three classes of directors have been established, referred to as “Class I directors”, “Class II directors”, and “Class III directors.” By separate action of the Board required under the Act, two members of the Board (Mr. Myers and Ms. Bridgewater) were designated as Class I directors; three members of the Board were designated as Class II directors (Mr. Kimball, Mr. Haynie and Mr. Wilkey); and three members of the Board were designated as Class III directors (Mr. Danos, Mr. Horak and Mr. Lamberti). The terms of the Class I directors continue in each caseoffice until the nextAnnual Meeting, and until their successors are elected. The Class II directors shall continue in office until one year following the Annual Meeting, and until their successors are elected. The Class III directors shall continue in office until two years following the Annual Meeting, and until their successors are elected. At each annual meeting of shareholders, commencing with the Annual Meeting, the successors to the class of directors whose term expires at that meeting shall be elected to hold office for a term of three years following such meeting and until a successor is duly elected and qualified.their successors are elected.

Information Concerning the Board’s Nominees

The Board of Directors has accepted the recommendation of the Nominating and Corporate Governance Committee that the eighttwo individuals named below be designated as the Board’s nominees for election to the Board of Directors as Class I directors at the Annual Meeting. Both of the Board’s nominees are currently Class I directors of the Company at the 2008 Annual Meeting of shareholders. All nominees are currently directors of the Company. Alland have been previously elected by the shareholders, except Jeffrey M. Lamberti who was appointed to the Board of Directors on March 5, 2008. Directors are elected to hold office until the next annual election and, in each case, until their respective successors are duly elected and qualified.shareholders.

Additional information regarding each of thesethe Board’s nominees is set forth below. The number of shares of Common Stock of the Company beneficially owned by each of the Board’s nominees as of July 25, 2008the Record Date is set forth on page 10.14. Except as may be otherwise expressly stated, allboth of the Board’s nominees for directorselection to the Board of Directors have been employed in the capacities indicated for more than five years.

It is intended that all proxies in(in the accompanying form,form), unless contrary instructions are given thereon, will be voted forFOR the election of all the two persons designated by the Board of Directors as nominees. In the event of death or disqualification of any nominee,either of the Board’s nominees, or the refusal or inability of any nomineeeither of the Board’s nominees to serve as a Class I director, the enclosed proxy may be voted with discretionary authority for the election of a substitute nominee approved by the Board of Directors.

The Board of Directors recommends a voteFOR election of the following nomineesNominees For Election as directors of the Company:Class I Directors—Terms to Expire in 2014

Ronald M. Lamb, 72, Chairman of the Board and retired Chairman of the Executive Committee. Mr. Lamb joined the Company in 1971, and served as Chairman of the Board and Chief Executive Officer from 1998 until June 21, 2006, and as Chairman of the Executive Committee from then until his retirement on April 30, 2008. Mr. Lamb has been a director of the Company since 1981.

3

Robert J. Myers, 61,64, President and Chief Executive Officer of the Company. Mr. Myers has been associated with the Company since 1989. He served as Senior Vice President from December 1998 until May 2002, when he assumed the position of Chief Operating Officer. He was elected to his current position as President and Chief Executive Officer onin June 21,2006, and has been a director of the Company since 2006. Mr. Myers brings to the Board extensive experience and knowledge regarding the convenience store industry, and a complete understanding of the Company’s business, its vision and strategy.

Diane C. Bridgewater, 48, Executive Vice-President, Chief Financial and Administrative Officer of LCS, a national leader in the planning, development and management of senior living communities and provider of senior living services. Prior to her employment with LCS in October 2006, Ms. Bridgewater was employed by Pioneer Hi-Bred International, Inc., a subsidiary of E.I. du Pont de Nemours & Company, for 18 years, in roles including Vice President and Chief Financial Officer and Vice President and Business Director, North America Operations. Ms. Bridgewater has been a director of the Company since 2007. Ms. Bridgewater brings a thorough knowledge and understanding of generally accepted accounting principles and auditing standards to the Board, and as an active chief financial officer, important insights as to corporate “best practices” and policies.

Directors Continuing in Office as Class II Directors—Terms to Expire in 2012

Kenneth H. Haynie, 75, former shareholder with78, retired lawyer and formerly “of counsel” to the Des Moines, Iowa law firm of Ahlers & Cooney, P.C. Since his retirement on December 31, 2002, he has served in an of counsel capacity, with no interest in the ownership or earnings of the law firm. He has served as a director of the Company since 1987. Through his legal and transactional experience as an attorney, Mr. Haynie brings a critical risk management perspective to the Board, along with a broad understanding of the Company’s business strategies and operational challenges.

Patricia Clare SullivanWilliam C. Kimball, 80, former President63, retired Chairman and Chief Executive Officer (1977-1993)of Medicap Pharmacy, Inc., Presidenta national franchisor of External Affairs (1993-1995)community retail pharmacies, and currently a partner in Kimball-Porter Investments, LLC, an Iowa-based investment company. Mr. Kimball also serves as a member of Mercy Health Centerthe Board of Central Iowa, Des Moines, Iowa. Ms. SullivanDirectors of Principal Mutual Funds. Mr. Kimball has served asbeen a director of the Company since 1996.2004. Mr. Kimball’s qualifications include his demonstrated leadership and knowledge of operational and financial issues facing a large retail corporation gained from his experience as founder and CEO of Medicap Pharmacy, and his understanding of retail markets and growth companies.

Richard A. Wilkey, 71, management and development consultant since 1990 to various companies in the Midwest. Mr. Wilkey is a former City Manager of the City of Des Moines (1974-85) and former

President of the Racing Association of Central Iowa (1986-89). He was employed by the Weitz Corporation (1985-90) as Executive Vice President of Administration and Finance and as President of Life Care Services Corporation, a major subsidiary of the Weitz Corporation. He has been a director of the Company since 2008. In addition to his experience providing strategic consulting services, Mr. Wilkey brings a broad public policy and local community perspective to the Board, along with extensive executive and management experience.

Directors Continuing in Office as Class III Directors—Terms to Expire in 2013

Johnny Danos, 68, former71, Director of Strategic Development for LWBJ, LLC, a public accounting and consulting firm located in West Des Moines, Iowa. From 1995 until 2008, Mr. Danos served as President of the Greater Des Moines Community Foundation, a charitable public foundation dedicated to improving the quality of life in Greater Des Moines. Mr. Danos was employed by KPMG LLP (and its predecessor firms) for over 30 years, and retired as the managing partner of its Des Moines office in 1995. He has been a director of the Company since 2004. Mr. Danos also is a member of the Board of Directors of the Federal Home Loan Bank of Des Moines.

William C. Kimball, 60, retired Chairman and Chief Executive Officer of Medicap Pharmacy, Inc., a national franchisor of community retail pharmacies. Mr. Kimball also serves as a member of the Board of Directors of Principal Mutual Funds and as Past Chair of the Board of Trustees of William Penn University. Mr. Kimball He has been a director of the Company since 2004.

Diane C. Bridgewater,45, Vice-President, Chief Financial Officer Mr. Danos brings extensive financial and Treasurer of Life Care Services, LLC, aaccounting experience to the Board, as well as broad community perspective and executive leadership skills from his experience with the Greater Des Moines-based manager and developer of continuing care retirement communities throughout the United States. Prior to her employment with Life Care Services, LLC, Ms. Bridgewater was employed by Pioneer, a DuPont Company for 18 years, most recently as its Vice President and Chief Financial Officer (2006). She also served as Vice President and Business Director, North America Operations (2004-2006) and Global Customer and Sales Services Director (2001-2003). Ms. Bridgewater has been a director of the Company since 2007.Moines Community Foundation.

Jeffrey M. Lamberti, 45,48, President and Managing Shareholder with the Ankeny, Iowa law firm of Handley, Block, Lamberti & Gocke, P.C. Mr. Lamberti served as an Iowa State Senator from 1999 to 2006 and as President of the Iowa Senate from 2004 to 2006. He is the son of Donald F. Lamberti, a founder of the Company. Mr. Lamberti has been a director of the Company since March 5, 2008. With his legal background and his experience in the Iowa General Assembly, Mr. Lamberti is able to provide important public policy, governance and legal perspective to the Board, as well as valuable operational and strategic expertise.

TheH. Lynn Horak, 65, past Regional Chairman with Wells Fargo Regional Banking. Mr. Horak held many positions with Wells Fargo Bank beginning in 1972, including Executive Vice President and Chief Financial Officer from 1981 to 1986, President and Chief Operating Officer from 1986 to 1991, and Chief Executive Officer and Chairman of the Board of Regional Banking for Iowa, Nebraska and Illinois from 1991 until November 2007. Mr. Horak served as a member of the Board of Directors of Iowa Telecommunications Services, Inc. until June 2010 and executive officersalso serves on the board of the Company will miss John R. Fitzgibbon,directors of four other non-public companies. He has been a director of the Company since 1983, who passed away on March 2, 2008.2009. Mr. Fitzgibbon provided well-reasoned adviceHorak brings a wealth of knowledge and counsel to the Boardexperience from his career with Wells Fargo, including significant executive leadership experience and will be missed by all who knew him.

The Boarda critical understanding of Directorsconsumer behavior and executive officers will also miss the insightful advice and leadership of Donald F. Lamberti, who resigned from the Board on March 4, 2008.

4retail markets.

In accordance with applicable Iowa law, theBoard of Directors

The business and affairs of the Company are managed under the direction of the Board of Directors. Directors are expected to attend all Board meetings and meetings of the committees on which they serve, and each annual shareholders meeting. All of the members ofoverseen by the Board of Directors attended last year’s Annual Meeting of shareholders, except Jeffrey M. Lamberti who was not a memberpursuant to the Iowa Business Corporation Act and the Bylaws. Members of the Board of Directors at that time.

The Board of Directors held four meetings during the fiscal year ended April 30, 2008, and each memberare kept informed of the Company’s business through discussions with the President and Chief Executive Officer, by reviewing materials provided to them, and by participating in Board of Directors attended 75% or more of the aggregate number of Board meetings and meetings of committees on which the member served.committee meetings. At intervals between formal meetings, members of the Board are provided with various items of information regarding the Company’s operations and are frequently consulted on an informal basis with respect to pending business.

Directors are expected to attend all Board meetings and meetings of the committees on which they serve and each annual shareholders meeting. The Board of Directors held seventeen meetings (four regular and thirteen special) during the fiscal year ended April 30, 2011 (the “2011 fiscal year”), and acted once by unanimous consent. Each incumbent director attended 75% or more of the aggregate number of Board meetings and meetings of committees on which the director served. All of the incumbent members of the Board of Directors attended last year’s annual meeting of shareholders.

Board Leadership Structure and Presiding Director

The Bylaws have for many years provided for a combined leadership structure, under which the Chief Executive Officer presides at all meetings of shareholders and the Board of Directors. Mr. Myers has been serving as chairman at meetings of the Board of Directors since March 2010, but has not been formally designated as Chairman of the Board. The Board has not appointed a lead independent director. The combined leadership structure has proven effective for the Company historically in terms of the Company’s financial performance and corporate governance. The Board believes that the current leadership position is the right corporate governance structure for the Company at this time because it most effectively utilizes Mr. Myers’s experience and knowledge concerning the Company, including by allowing him to lead Board discussions regarding the Company’s business and strategy, and provides unified leadership for the Company.

Although the Board believes that it is most effective for the Chief Executive Officer to preside at meetings of the Board of Directors, it also recognizes the importance and need for strong independent leadership on the Board. Consistent with that belief, the independent directors (seven of the eight individuals currently serving on the Board are considered independent under the Nasdaq Listing Standards) met in executive session without management present six times during the 2011 fiscal year, and the Board has determined that such executive sessions will continue to be held at least twice each year in the future. The presiding director at such meetings generally has been Mr. Kimball. The Board also believes the standing Board committees (described below) help provide appropriate oversight and independent leadership.

Director Independence

In making independence determinations, the Board of Directors observes the criteria for independence set forth in the Nasdaq Listing Standards. Consistent with these criteria, the Board has reviewed all relationships and material transactions between the Company and members of the Board (and any affiliated companies), and has affirmatively determined that Ms. Bridgewater, Mr. Danos, Mr. Haynie, Mr. Danos,Horak, Mr. Kimball, Ms. SullivanMr. Lamberti and Ms. BridgewaterMr. Wilkey are considered “independent” directors, as that term is defined inindependent within the meaning of the Nasdaq Listing Standards. As such, a substantial majority of the Board of Directors is considered “independent” as so defined. In reaching this conclusion, the Board of Directors considered the facts and circumstances of Mr. Haynie’s relationship with Ahlers &and Cooney, P.C., andincluding the fact that he has had no interest in the ownership or earnings of the law firm since his retirement in 2002. In light of the foregoing, the Board determined that the relationship was not material and does not interfere with Mr. Haynie’s independent judgment in carrying out his responsibilities as a director. The independent directors met in executive session without management present during two of the Board meetings held during the fiscal year ended April 30, 2008, and the Board of Directors also considered the payments that Mr. Lamberti’s father, Donald F. Lamberti, receives from the

Company under the Non-Qualified Supplemental Executive Retirement Plan (which the Board determined to be non-discretionary retirement compensation) and the contingent beneficial interest Mr. Lamberti has under the trust agreement described under “Director Compensation—Certain Relationships and Related Transactions” and concluded that neither interest was material or would interfere with the exercise of Mr. Lamberti’s independent judgment in carrying out his responsibilities as a director. Finally, in considering Mr. Horak’s independence, the Board considered the payments made by the Company to Iowa Telecommunications Services, Inc. in the ordinary course for telecommunication services, and determined that such executive sessions will be held at least twice each yearthese payments were not material and would not interfere with Mr. Horak’s independent judgment in the future.carrying out his responsibilities as a director.

Board Committees

The Bylaws of the Company establish four standing committees of the Board of Directors: the Executive Committee, the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. In addition, the Bylaws authorize the Board of Directors to establish other committees for selected purposes.

Executive Committee

The Executive Committee presently consistingconsists of Mr. Lamb (Chair),Myers, Mr. MyersHaynie, Mr. Kimball and Mr. Haynie,Wilkey. The Executive Committee is authorized, within certain limitations set forth in the Bylaws, to exercise the power and authority of the Board of Directors between meetings of the full Board. The Executive Committee met oncedid not meet during the 2011 fiscal year ended April 30, 2008.year.

Audit Committee

The Audit Committee presently consists of Ms. Bridgewater (Chair), Mr. Danos, Mr. KimballLamberti and Ms. Sullivan,Mr. Horak, all of whom are “independent” under the criteria established by the SEC and Nasdaq.the Nasdaq Listing Standards. The Board of Directors has approved the designation of Ms. Bridgewater as an “audit committee financial expert” as that is defined under Item 401(h)407(d)(5) of SEC Regulation S-K.

The Audit Committee performs the duties set forth in its written Charter (which is available on the Company’s website—www.caseys.com)Web site—www.caseys.com). Under its Charter, the Audit Committee is directly responsible for the appointment, termination, compensation and oversight of the independent public accounting firm it retains to audit the Company’s books and records. The Audit Committee regularly reports to the Board on the audit and the non-audit activities of the auditors, approves all audit engagement fees and pre-approves any non-audit engagement and compensation of the independent auditors.

5

The Audit Committee has established a regular schedule of meetings to be held five times each year with financial management personnel, internal accounting and auditing staff and the independent auditor. During these meetings, the Audit Committee also meets separately in executive sessions with the internal auditing staff and the independent auditor. The Audit Committee met five times during the 2011 fiscal year ended April 30, 2008.year. The report of the Audit Committee is included herein on page 38.

Compensation Committee

The Compensation Committee presently consists of Mr. Haynie (Chair), Mr. Danos,Kimball, Mr. Kimball, Ms. SullivanWilkey and Ms. Bridgewater,Mr. Horak, all of whom are “independent” under the Nasdaq criteria.Listing Standards. The Compensation Committee annually reviews the performance of the Chief Executive Officer and reviews management’s evaluation of the performance of the Company’s senior officers and their compensation arrangements, and makes recommendations to the Board of Directors concerning the compensation of the Chief Executive Officer and the Company’s senior officers. The Compensation Committee’s determination (and its deliberations) of the Chief Executive Officer’s compensation are done in executive session, without the presence of management, including the Chief Executive Officer. The Chief Executive Officer may make recommendations regarding the

compensation of executive officers and participate in such deliberations but shall not vote to approve or recommend any form of compensation for such executive officers. The Compensation Committee also authorizes awards of stock options and restricted stock units to the executive officers, and from time to time, makes recommendations regarding the compensation of directors. As set forth in its written Charter (which is available on the Company’s website—www.caseys.com)Web site—www.caseys.com), the Compensation Committee has authority to retain and terminate executive compensation consulting firms to advise the Compensation Committee and, from time to time, retains compensation consultants to assist with the Compensation Committee’s review and development of its compensation recommendations. Most recently,During the fiscal year ended April 30, 2009 and the 2010 fiscal year, the Compensation Committee retained the services of Hewitt Associates, as a consultant to assist itan independent human resources consulting firm, in preparingconnection with the employment agreement betweencreation and implementation of the CompanyCasey’s General Stores, Inc. 2009 Stock Incentive Plan (the “2009 Stock Incentive Plan”). The scope and Mr. Myers that was executed in March 2007. The Committee also has retainednature of the services provided by Hewitt Associates were limited to assist in reviewing possible long term incentiveassisting and advising the Compensation Committee on the terms and conditions of the 2009 Stock Incentive Plan. Hewitt Associates reported on such matters directly and exclusively to the Compensation Committee and did not do any other work for the Company. No compensation arrangements.

The Compensation Committee also administers the 20002009 Stock OptionIncentive Plan, which was approved by the shareholders at the 2009 annual meeting of shareholders. The practice of the Company. The current practice has beenCompensation Committee under the predecessor stock option plan was to consider a grant of stock options every other year in June. The Board of Directors has approved a policy statement concerning the granting of stock options as described on page 14.(see the discussion under “Compensation Discussion and Analysis—Additional Compensation Policies—Option Grants”). Grants of all stock options are required to be made at the last reported sales price of the underlying shares on the grant date.

The Compensation Committee met twicefive times during the 2011 fiscal year ended April 30, 2008.year. The report of the Compensation Committee is included herein on page 17.

Compensation Committee Interlocks and Insider Participation23.

No member of the Compensation Committee is or has been an officer or employee of the Company or had any relationship that is required to be disclosed as a transaction with a related party.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee presently consists of Ms. SullivanMr. Lamberti (Chair), Mr. Haynie, Mr. Danos, Mr. Kimball and Ms. BridgewaterMr. Wilkey, all of whom are “independent” under the Nasdaq criteria.Listing Standards. The Nominating and Corporate Governance Committee generally reviews the qualifications of candidates proposed for nomination to the Board of Directors, recommends to the Board candidates for election at the Annual Meetingannual meeting of shareholders and performs the other duties set forth in its written Charter (which is available on the Company’s website—www.caseys.com)Web site—www.caseys.com). Under Charter amendments approved by the Board of Directors in December 2008, the Nominating and Corporate Governance Committee’s responsibilities were expanded to include the recommendation to the Board of corporate governance policies or guidelines that should be applicable to the Company, and the responsibility to lead the Board in an annual review of the Board’s performance (see “Governance Policies” below). The Nominating and Corporate Governance Committee met twice and acted once by unanimous consent during the 2011 fiscal year ended April 30, 2008.year.

6

The Nominating and Corporate Governance Committee will consider nominees recommended by shareholders if they are submitted in accordance with the Amended and Restated Bylaws (“Bylaws”).Bylaws. Briefly, the Bylaws contain specific advance notice procedures relating to shareholder nominations of directors and other business to be brought before an annual or special meeting of shareholders other than by or at the direction of the Board of Directors. Under the Bylaws, in order for a shareholder to nominate a director candidate for election at an annual meeting of shareholders, the shareholder must deliver written notice thereof to the Corporate Secretary of the Company at leastnot less than 90 days nor more than 120 days prior to the one-yearfirst anniversary date of the date of the immediately preceding annual meeting of shareholders. In the case of shareholder nominations to be considered at the 2009 Annual Meeting, 2012 annual meeting,

therefore, such notice must be received by the Corporate Secretary by no earlier than May 19, 2012 and no later than June 19, 2009.18, 2012. The notice must set forth certain information concerning such shareholder and the shareholder’s nominee(s), including but not limited to their names and addresses, occupation, share ownership, rights to acquire shares and other derivative securities or short interests held, a representation that the shareholder is entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, a description of all arrangements or understandings between the shareholder and each nominee, such other information as would be required to be included in a proxy statement pursuant to the proxy rules of the SEC had the nominee(s) been nominated by the Board of Directors, and the consent of each nominee to serve as a director of the Company if so elected. The chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.provisions of the Bylaws. A copy of the Bylaws may be obtained by request addressed to Brian J. Johnson, Director of Vice President—Finance and Corporate Secretary, Casey’s General Stores, Inc., P.O. Box 3001, One Convenience Blvd., Ankeny, Iowa 50021.50021-8045.

The Nominating Committee’s Charter sets forth, among other things, the minimum qualifications that the Nominating and Corporate Governance Committee believes must be met by a Nominating Committee-recommended nominee, and the specific qualities or skills that the Nominating and Corporate Governance Committee believes are necessary for one or more of the Company’s directors to possess. In considering individuals for nomination as directors, the Nominating and Corporate Governance Committee typically solicits recommendations from the current directors and is authorized to engage search firms to assist in the process, although it has not done so to date.

7

DIRECTOR COMPENSATION

DuringThe Nominating and Corporate Governance Committee considers a number of factors in making its nominee recommendations to the fiscal year ended April 30, 2008,Board, including, among other things, a candidate’s employment and other professional experience, past expertise and involvement in areas which are relevant to the Company’s business, business ethics and professional reputation, independence, other board experience and the Company’s desire to have a Board that represents a diverse mix of backgrounds, perspectives and expertise. In addition to the information set forth above concerning each director who was not a Company employee was compensated for servicesof the Board’s nominee’s specific experience and qualifications that led the Nominating and Corporate Governance Committee to conclude that he or she should serve as a director, by an annual retainer of $25,000the Nominating and a meeting fee of $1,000 forCorporate Governance Committee believes each shareholder, Board and Committee meeting attended. The Chair of the Compensation,incumbent directors has demonstrated outstanding achievement in his or her professional career, wisdom, personal and professional integrity, and independent judgment.

The Company does not have a formal policy for considering diversity in identifying and recommending nominees for election to the Board, but the Nominating and Audit CommitteesCorporate Governance Committee considers diversity of viewpoint, experience, background and other qualities in its overall consideration of nominees qualified for election to the Board.

Succession Planning Committee

In December 2008, the Board of Directors established a Succession Planning Committee, with Mr. Danos serving as its Chair, to regularly review succession planning for the Chief Executive Officer and other executive officer positions. Other members of the Succession Planning Committee include Messrs. Kimball, Lamberti, Wilkey and Horak. The Succession Planning Committee met once during the 2011 fiscal year.

Governance Policies

In March 2009, the Nominating and Corporate Governance Committee recommended, and the Board of Directors approved, several corporate governance policies that were compensated for such services by an annual retainer of $5,000.considered to be generally consistent with current Board or Company employeespractice, even though they had not been previously stated as a formal policy position:

1. That the Chief Executive Officer be prohibited from serving on the Board do not receive any compensationboards of more than two other companies, which for servicesthis purpose includes public companies as well as not-for-profit organizations or other entities that are likely to require a director. The Company reimburses all directors for travel and other necessary business expenses incurred in the performance of their services for the Company and extends coveragesimilar time commitment. Prior notice to them under the Company’s group life insurance plan, with individual coverages of up to $50,000 each.

Effective May 1, 2008, the annual retainer for non-employee directors will be increased to $40,000 and Board meeting fees will be eliminated, while Committee meeting fees will remain at $1,000. The annual retainer for the Board and Committee chairs also will be increased to $6,000. Non-employee directors also will be reimbursed for costs associated with their attendance at seminars relating to corporate governance matters, up to a maximum of $5,000 per year.Directors is required before acceptance of any such position.

Under the Non-Employee Directors’ Stock Option Plan approved by the shareholders at the 1995 Annual Meeting (the “Director Stock Plan”), each Eligible Non-Employee Director (defined in the Director Stock Plan as any person who is serving as a non-employee director

2. That all members of the CompanyBoard of Directors serve on no more than two other public company boards. In addition, service on the last dayboards of a fiscal year) annually receives an option to purchase 2,000 shares of Common Stock. The exercise price of all options awarded under the Director Stock Plan is the average of the last reported sale prices of shares of Common Stock on the last trading day of each of the 12 months preceding the award of the option. The term of such options is ten years from the date of grant, and each option is exercisable immediately upon grant. The aggregate number of shares of Common Stocknot-for-profit organizations or other entities that may be granted pursuant to the Director Stock Plan may not exceed 200,000 shares, subject to adjustment to reflect any future stock dividends, stock splits or other relevant capitalization changes. In accordance with the terms of the Director Stock Plan, Messrs. Haynie, Danos, Kimball, Lamberti, Ms. Sullivan and Ms. Bridgewater each received an option on May 1, 2007 to purchase 2,000 shares of Common Stock at an exercise price of $24.11 per share.

The following table sets out the compensation paid to or on behalf of our directors during the fiscal year ended April 30, 2008:

Director Compensation Table

Director | Fees Earned or Paid in Cash ($) | Option Awards ($)2 | All Other Compensation ($)3 | Total ($) | |||||||||

Donald F. Lamberti1 | $ | 27,500 | $ | 23,300 | $ | 288,010 | 4 | $ | 338,810 | ||||

John R. Fitzgibbon5 | 39,000 | 23,300 | 35 | 62,335 | |||||||||

Kenneth H. Haynie | 29,500 | 23,300 | 38 | 52,838 | |||||||||

Patricia Clare Sullivan | 41,000 | 23,300 | 38 | 64,338 | |||||||||

Johnny Danos | 43,375 | 23,300 | 62 | 66,737 | |||||||||

William C. Kimball | 41,500 | 23,300 | 96 | 64,896 | |||||||||

Diane C. Bridgewater | 44,125 | 23,300 | 96 | 67,521 | |||||||||

Jeffrey M. Lamberti6 | 11,250 | — | 16 | 11,266 | |||||||||

|

|

|

|

8

|

|

|

|

|

|

|

|

Certain Relationships and Related Transactions

The Company hasrequire a written policy requiring the approval by the Audit Committee of transactions between the Company and “related parties” thatsimilar time commitment are required to be disclosed under Item 404and acceptable to the Board.

3. That all members of Regulation S-K, unless the transaction is availableBoard of Directors attend at least one director education or governance-related program every three years.

4. That the Succession Planning Committee of the Board regularly review a succession plan with the Chief Executive Officer and keep the full Board informed of its discussions with the Chief Executive Officer on succession planning matters.

5. That all members of the Board of Directors commit to all employees generally or unless the transaction involves less than $5,000, when aggregated with all similar transactions. “Related parties” include senior officers or directors (and their immediate family members),becoming shareholders owning more than five percent of the Company orwithin two years of their election to the Board, and that all executive officers similarly maintain an entity that is either owned or controlled by such individuals or an entity over which such individuals have a substantial ownership interest in the Common Stock of the Company, either directly or control.through the KSOP.

AtThe Nominating and Corporate Governance Committee typically conducts an annual review of the Board’s performance.

Board’s Role in Risk Oversight

The Board as a whole has on-going responsibility for risk management oversight, with reviews of certain areas being conducted by the relevant Board committees that report on their deliberations to the Board. The oversight responsibility of the Board and its committees is largely achieved through periodic reporting by management to the Board about the identification, assessment and management of critical risks and management’s risk mitigation strategies. A Risk Committee (comprised of senior management and other key personnel) meets quarterly to provide recommendations to the Chief Executive Officer for further action, with periodic progress reports on the same being provided to the Board of Directors. Oversight responsibilities for various risks have been assigned to different Risk Committee members and are reviewed annually, and coordinated with internal audit and the independent auditors. Areas of focus include competitive, economic, operational, financial, legal, regulatory, compliance, health, safety and environment, political and reputational risks.

Shareholder Communications

It is the general policy of the Board that management speaks for the Company. To the extent shareholders would like to communicate with a Company representative, they may do so by contacting William J. Walljasper, Chief Financial Officer, Casey’s General Stores, Inc., P.O: Box 3001, One Convenience Blvd., Ankeny, Iowa 50021-8045. Mr. Walljasper also can be reached by telephone at (515) 965-6505.

Any shareholder wishing to communicate with one store location inor more Board members should address a written communication to Diane C. Bridgewater, Chair of the Audit Committee, at Capital Square, 400 Locust Street, Suite 820, Des Moines, Iowa 50309-2334. Ms. Bridgewater will forward such communication on to all of the members of the Board, to the extent such communications are deemed appropriate for consideration by the Board.

The Company currently has five executive officers and seven other Vice Presidents. The current executive officers are as follows:

Name | Current Office Held | First Became Executive Officer | Age | |||||||

Robert J. Myers | President and Chief Executive Officer | 1999 | 64 | |||||||

Terry W. Handley | Chief Operating Officer | 2002 | 51 | |||||||

William J. Walljasper | Senior Vice President and Chief Financial Officer | 2004 | 47 | |||||||

Sam J. Billmeyer | Senior Vice President – Logistics & Acquisitions | 2006 | 54 | |||||||

Julia L. Jackowski | Senior Vice President – General Counsel & Human Resources | 2010 | 45 | |||||||

During the past five years, each of the executive officers has served the Company owns the buildingin various executive or administrative positions. Prior to his appointment as President and currently leases the land from a trust created by Donald F. Lamberti’s mother. The Company’s lease extends until September 2012Chief Executive Officer on June 20, 2006, Mr. Myers served as President and provides for a fixed monthly rental payment of $1,300 and payment of an amount equal to 1% of sales by the store. The Company has an option to purchase the property for its fair market value at the endChief Operating Officer of the lease term. Company. Mr. Handley, who has been Chief Operating Officer since June 20, 2006, previously served as Senior Vice President—Store Operations. Mr. Walljasper, who had been Vice President and Chief Financial Officer since 2004, assumed the title of Senior Vice President and Chief Financial Officer on June 20, 2006. Mr. Billmeyer was appointed Senior Vice President—Logistics and Acquisitions on May 1, 2008. Prior to that date, he served as Senior Vice President—Transportation & Support Operations and as Vice President—Transportation. Ms. Jackowski became Senior Vice President—General Counsel & Human Resources effective June 6, 2010. Previously she was Vice President—Human Resources.

The amounts paid byfollowing table contains information with respect to each person, including any group, known to the Company underto be the lease duringbeneficial owner of more than 5% of the past three fiscal years were $70,819Common Stock as of the dates indicated in fiscal 2008, $62,740the footnotes following the table. Except as otherwise indicated, the persons listed in fiscal 2007the table have the voting and $57,370 in fiscal 2006. The Company does not intendinvestment powers with respect to lease additional store sites or buildings from affiliated persons.the shares indicated.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

Black Rock, Inc. 40 East 52nd Street New York, NY 10022 | 2,940,238 | (1) | 7.75 | % | ||||

NFJ Investment Group LLC 2100 Ross Avenue, Suite 700 Dallas, TX 75201 | 2,134,000 | (2) | 5.60 | % | ||||

Piper Jaffray Companies 800 Nicollet Mall, Suite 800 Minneapolis, MN 55402 | 1,973,901 | (3) | 5.20 | % | ||||

The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | 2,023,563 | (4) | 5.33 | % | ||||

9

| (1) | Based on Schedule 13G filed by Black Rock, Inc. with the SEC dated January 21, 2011 (the “Black Rock 13G”). Such information indicates that such entity has sole voting power over 2,940,238 shares and sole dispositive power over 2,940,238 shares. The Percent of Class information is as reported in the Black Rock 13G. |

| (2) | Based on Schedule 13G filed by NFJ Investment Group LLC (“NFJ”) and Allianz Global Investors Capital LLC (“AGIC”) with the SEC dated February 10, 2011 (the “NFJ 13G”). Such information indicates that NFJ, a wholly owned subsidiary of AGIC, has sole voting power over 2,114,800 shares and sole dispositive power over 2,134,000 shares. The Percent of Class information is as reported in the NFJ 13G. |

| (3) | Based on Schedule 13G filed by Piper Jaffray Companies (“Piper”) with the SEC dated February 10, 2011 (“Piper 13G”). Such information indicates that Advisory Research, Inc., a wholly owned subsidiary of Piper, has sole voting and dispositive power over 1,973,901 shares. The Percent of Class information is as reported in the Piper 13G. |

| (4) | Based on Schedule 13G filed by The Vanguard Group, Inc. (“Vanguard”) with the SEC dated February 9, 2011 (“Vanguard 13G”). Such information indicates that Vanguard Fiduciary Trust Company, a wholly owned subsidiary of Vanguard, has sole voting power over 55,929 shares, and that Vanguard has sole dispositive power over 1,967,634 shares and shared dispositive power over 55,929 shares. The Percent of Class information is as reported in the Vanguard 13G. |

BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK

BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as of July 25, 2008,2011 (other than with respect to the KSOP shares, which is as of April 30, 2011, as discussed in footnote 2 to the following table), the beneficial ownership of shares of the Company’s Common Stock, the only class of capital stock outstanding, by the current directors and the Board’s nominees for directorselection to the Board of the Company,Directors, the executive officers named in the Summary Compensation Table herein, and all current directors and executive officers as a group. Except as otherwise indicated, the shareholders listed in the table have thesole voting and investment powers with respect to the shares indicated.

Name of Beneficial Owner | Direct Ownership | Shares Subject to Options(1) | KSOP Shares(2) | Total Amount and Nature of Beneficial Ownership(3) | Percent of Class | Direct Ownership | Shares Subject to Options(1) | KSOP Shares(2) | Total Amount and Nature of Beneficial Ownership(3) | Percent of Class | ||||||||||||||||||||||

Ronald M. Lamb | 709,470 | — | — | 709,470 | 1.4 | % | ||||||||||||||||||||||||||

Robert J. Myers | 18,000 | 40,000 | 6,869 | 64,869 | * | 48,000 | 10,000 | 7,536 | 65,536 | * | ||||||||||||||||||||||

Kenneth H. Haynie | 32,662 | 20,000 | — | 52,662 | * | 29,162 | (4) | 14,000 | — | 43,162 | * | |||||||||||||||||||||

Patricia Clare Sullivan | 5,480 | 12,000 | — | 17,480 | * | |||||||||||||||||||||||||||

Johnny Danos | 7,175 | 10,000 | — | 17,175 | * | 11,275 | (4) | 12,000 | — | 23,275 | * | |||||||||||||||||||||

William C. Kimball | 3,461 | (4) | 10,000 | — | 13,461 | * | 7,541 | (4) | 12,000 | — | 19,541 | * | ||||||||||||||||||||

Diane C. Bridgewater | — | 4,000 | — | 4,000 | * | 4,000 | 6,000 | — | 10,000 | * | ||||||||||||||||||||||

Jeffrey M. Lamberti | 25,300 | (5) | 2,000 | — | 27,300 | * | 36,450 | (4) | 4,000 | — | 40,450 | * | ||||||||||||||||||||

Richard A. Wilkey | 4,000 | 2,000 | — | 6,000 | * | |||||||||||||||||||||||||||

H. Lynn Horak | 4,000 | — | — | 4,000 | * | |||||||||||||||||||||||||||

Terry W. Handley | — | 50,000 | 9,303 | 59,303 | * | — | 30,000 | 9,890 | 39,890 | * | ||||||||||||||||||||||

William J. Walljasper | — | 33,500 | 4,616 | 38,116 | * | 2,000 | 30,000 | 4,976 | 36,976 | * | ||||||||||||||||||||||

Sam J. Billmeyer | — | 30,000 | 3,701 | 33,701 | * | — | 30,000 | 4,019 | 34,019 | * | ||||||||||||||||||||||

All current executive officers and directors as a group (11 persons) | 801,548 | 211,500 | 24,489 | 1,037,537 | 2.0 | % | ||||||||||||||||||||||||||

Julia L. Jackowski | 6,500 | 22,500 | 2,891 | 31,891 | * | |||||||||||||||||||||||||||

All current executive officers and directors as a | 152,928 | 172,500 | 29,312 | 354,740 | * | |||||||||||||||||||||||||||

| * | Less than 1% |

| (1) | Consisting of shares (which are included in the totals) that are subject to acquisition within 60 days of July 25, 2011 through the exercise of stock options, |

| (2) | The amounts shown (which are included in the totals) consist of shares allocated to the named executive officers’ accounts in the KSOP as of April 30, |

| (3) | Except as otherwise indicated, the amounts shown are the aggregate numbers of shares attributable to the |

| (4) |

| (5) |

10

See also “Equity Compensation Plan Information” below.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), requires the Company’s officers, directors and owners of more than 10% of the outstanding Common Stock to file reports of ownership and changes in ownership with the SEC, and also to furnish the Company with a copy of all such reports that they file. Based solely upon a review of the copies of the reports furnished to the Company, all such reporting persons complied with such reporting obligations during the 2011 fiscal year, endedexcept that reports were inadvertently not filed in a timely manner for (i) the exercise of a stock option by Mr. Haynie on April 30, 2008, except21, 2011 in respect of 2,000 shares and (ii) Mr. FitzgibbonLamberti’s appointment on April 6, 2011 as co-trustee of family trusts, which hold an aggregate of 7,000 shares of Common Stock over which the co-trustees share voting and dispositive power. Mr. Haynie’s report was filed on May 9, 2011 and Mr. Haynie eachLamberti’s report was filed one report late with respect to his exercise of an option granted under the Director Stock Plan.

11on July 26, 2011.

COMPENSATION DISCUSSION AND ANALYSIS

The following section provides a discussion and analysis of compensation paid or awarded to the namedwere our “named executive officersofficers” for the 2011 fiscal year ended April 30, 2008.year: Robert J. Myers, President and Chief Executive Officer; Terry W. Handley, Chief Operating Officer; William J. Walljasper, Senior Vice President and Chief Financial Officer; Sam J. Billmeyer, Senior Vice President—Logistics & Acquisitions; and Julia L. Jackowski, Senior Vice President—Corporate Counsel and Human Resources. In this section, the words “our” and “we” refer to the Company, andword “Committee” refers to the Compensation Committee of the Board of Directors.

Executive Compensation Strategy/Strategy and Objectives

Our executive compensation policies are designed to attract, motivate and retain executives who will contribute to the long-term success of the Company and to reward executives for achieving both short-term and long-term strategic goals of ourthe Company. We also believe it is important to align the interests of the executives with those of our shareholders. In order to achieve these objectives, a significant portion of the compensation forof our named executive officers is linked directly to ourthe Company’s financial performance.performance and to the value of the Common Stock. The Board’s goal is to approve compensation that is reasonable and competitive when all elements of potential compensation are considered.

Role of the Board, the Committee and our Chief Executive Officer in Compensation Decisions for our Named Executive Officers

The Board is responsible for approving base salary increases for each of our named executive officers and approving the performance goals under our annual incentive compensation program. With respect to our named executive officers, the Committee is charged with recommending base salary increases for the Board’s consideration, determining the terms of the annual incentive compensation program and approving stock option grants in the years in which such grants are made. Our Chief Executive Officer is tasked with developing recommendations for the Committee’s consideration for base salary increases and stock option grants for our named executive officers (other than increases in his own base salary and stock option grants to himself, which are determined solely by the Committee).

During the 2011 fiscal year, neither the Board nor the Company engaged a compensation consultant for any purpose.

Components of Compensation

OurAs in prior years, our compensation program hasfor the 2011 fiscal year had four primary components: base salary; short-termannual incentive (bonus) compensation; a long-term incentive compensation in the form of stock option grants;options; and benefits. A significant portion of an executive’sa named executive officer’s compensation is placed at risk, and the only fixed compensation paid is base salary and benefits. The remaining total compensation (short-term incentive bonuses(annual and long-term stock option awards)incentive compensation) for our named executive officers is not guaranteed and the value to theeach executive officer is based on the Company’s and the executive’s performance.

Each executive’s total We believe that this mix of compensation is reviewed in June of each year. Compensation decisions made in June regarding salary increases become effective as of the prior May 1. Stock options typically are awarded every other year. All of these decisions are made in the context of the Company’s performance against targetselements appropriately balances short-term and the individual’s performance against performancelong-term business goals and objectives.

In making recommendationsaligns the interests of our named executive officers with respect to any element of an executive officer’s compensation, the Committee considers the total compensation, including salary, annual bonus and long-term incentive compensation. The Committee’s goal is to recommend compensation that is reasonable and competitive when all elements of potential compensation are considered.our shareholders.

Base Salary

Our Chief Executive Officer recommends the individual base salaries for all other executive officers and the Vice Presidents. Base salaries for executive officers and Vice Presidents of the Company are determined primarily on the basis of each executive officer’s experience, performance and individual responsibilities. Comparative data prepared by theEach fiscal year, our Chief Executive Officer or executive compensation consulting firms also has been considered from time to time byreviews the Committee. Individualbase salaries are reviewed annually. For fiscal year 2008,of the other senior officers, including our named executive officers, received salary increases based on individualin connection with their performance as well as overallreviews. The Chief Executive Officer is assisted in this review by the Director of Human Resources, which includes consideration of internal and external pay equity that ranged from 3.3% to 12.5%.

The base salary of Mr. Myers is set forth in his employment agreement withwithin the Company and may be adjusted duringcomparisons with publicly available information from a variety of sources relating to compensation levels for executives serving in

various roles at other companies. Based on such reviews, our Chief Executive Officer develops his recommendations for the term thereof withindividual base salaries for all of the consentsenior officers, including our named executive officers, and provides his recommendations to the Committee. The Committee considers our Chief Executive Officer’s recommendations and then recommends the new base salaries for the senior officers, including our named executive officers, to the Board for approval in June of each fiscal year.

Mr. Myers. Effective May 1, 2007, Mr. Myers’Myers’s base salary for the 2011 fiscal year was increased$726,000, reflecting a 10% increase from $500,000 to $600,000 and effective May 1, 2008, Mr. Myers’the amount of his base salary was increased to $660,000. In recommendingfor the fiscal year ended April 30, 2010. Messrs. Handley and Billmeyer each received a $30,000 increase in base salary for the 2011 fiscal year. Mr. Walljasper received a $50,000 increase and Ms. Jackowski received a $100,000 increase in base salary for the 2011 fiscal year. These increases, which were all approved in June 2010, were based on the respective subjective views of our Chief Executive Officer, the Committee considered Mr. Myers’ experience,and the Board, which were primarily influenced by each executive officer’s recent performance and responsibilities, along with the quality of Mr. Myers’ leadership in promotingcontribution to the Company’s strategic growth.success, as described above.

12

Annual Incentive Payments (Bonus)Compensation Program

Overview

The executivesenior officers of the Company, including theour named executive officers, and its Vice Presidents, annually participate in an annual incentive compensation bonus pool.